top of page

Call or Text: 980-272-7322

Search

Part IV: How to Negotiate Better Terms in the Florida Business Brokers Contract - If You Must Use It

After three comprehensive parts analyzing the Business Brokers of Florida standard Asset Purchase Agreement, Howard Law's position remains unchanged: buyers should refuse to execute this document in any form and instead demand attorney-drafted purchase agreements that actually protect their interests.

Evan Howard

Oct 10, 202513 min read

Part III: The Remaining Traps in the Florida Business Brokers Contract - Environmental Disclaimers, Tax Provisions, and Enforcement Barriers

The BBF contract represents sophisticated drafting designed to create maximum advantage for brokers and sellers while shifting maximum risk to buyers who will bear the greatest financial exposure in these transactions.

Evan Howard

Oct 9, 202512 min read

Part II: Dissecting the Florida Business Brokers Contract - The Buyer Trap Exposed

The BBF Asset Purchase Contract represents a masterclass in one-sided contract drafting designed to protect everyone except the buyers who will bear the greatest financial risk in these transactions.

Evan Howard

Oct 8, 202513 min read

Florida Business Brokers and Unauthorized Practice of Law: What Buyers Need to Know

Florida business brokers routinely violate unauthorized practice law. Learn how these violations cost buyers thousands. Expert guidance from Howard Law NC attorneys.

Evan Howard

Oct 7, 202515 min read

Unreasonable Restraint on Trade: Legal Principles, Case Law, and Statutory Framework

The concept of unreasonable restraint of trade is a cornerstone of American antitrust law, shaping the way businesses interact, compete, and innovate - but also elusive and hard to understand. At its heart, this legal doctrine is designed to ensure that competition remains fair and robust, protecting both consumers and the broader economy from the harms of monopolistic or collusive behavior.

Evan Howard

Jun 25, 20258 min read

Supreme Court Clarifies Corporate Affiliate Liability Under the Lanham Act: Key Takeaways from Dewberry Group v. Dewberry Engineers

In February 2025, the United States Supreme Court issued a landmark ruling in Dewberry Group, Inc. v. Dewberry Engineers Inc., clarifying the boundaries of liability for corporate affiliates in trademark infringement cases under the Lanham Act. The decision, which reversed a $43 million disgorgement award against Dewberry Group that included the profits of its affiliated companies, has sent ripples through the corporate, intellectual property, and M&A legal communities.

Evan Howard

Jun 23, 20258 min read

Legal Issues and Tax Implications When Acquiring an S-Corporation

Acquiring an S-Corporation is a significant event for both buyers and sellers, and it’s not as simple as just signing on the dotted line. The process is filled with legal and tax considerations that can have long lasting effects on both parties; a process that is unique to S-Corporations. If you’re contemplating such a transaction, it’s crucial to understand not just the basics, but also the issues that can arise.

Evan Howard

Jun 20, 20259 min read

Successor Employer Liability in North Carolina: Navigating Employee Misclassification and Risks after an Acquisition

Purchasing a business in North Carolina can be a lucrative and exciting opportunity, but it also comes with a web of legal, financial, and operational risks. One of the most significant, and overlooked, risks is that of successor employer liability. This risk is particularly relevant when the seller has engaged in employee misclassification, treating workers as independent contractors (1099) when the law requires them to be classified as employees (W-2).

Evan Howard

Jun 9, 202516 min read

Tax Implications and Consequences of Multi-Step Transactions in Mergers and Acquisitions

Multi-step transactions in mergers and acquisitions are not just strategic maneuvers for operational integration-they are also critical tools for optimizing tax outcomes. These structures, which unfold across phased legal and financial steps, create unique opportunities and challenges for buyers, sellers, and their advisors.

Evan Howard

Jun 6, 20256 min read

Understanding IRC 704(c): An Analysis of Tax Implications for Partnership Contributions

IRC Section 704(c) is a critical provision of the Internal Revenue Code that addresses how partnerships must allocate income, gain, loss, and deduction with respect to property contributed by partners. The fundamental purpose of Section 704(c) is to prevent the shifting of tax consequences among partners with respect to precontribution gain or loss.

Evan Howard

Jun 4, 20256 min read

Section 336(e) Election: A Guide for Buyers and Sellers

When structuring the sale or acquisition of a business, understanding the tax implications is crucial because they can significantly affect the overall value of the transaction for both buyers and sellers. Among the various tax provisions available, two stand out for their ability to transform stock sales into asset sales for tax purposes: Section 336(e) and Section 338(h)(10) of the Internal Revenue Code.

Evan Howard

Jun 2, 20258 min read

Understanding Multi-Step Transactions in Mergers and Acquisitions

While the concept of one company buying another seems straightforward on the surface, the reality is far more intricate. Many M&A deals, especially those involving public companies or complex ownership structures, require a series of coordinated legal and financial steps to achieve the desired outcome.

Evan Howard

May 9, 20257 min read

Understanding the Difference Between Non-Disclosure Agreements and Confidentiality Agreements

When it comes to protecting sensitive business information, two terms often come up: non-disclosure agreement (NDA) and confidentiality agreement.

Evan Howard

May 4, 20256 min read

Creative Financing in Business Acquisition: A Case Study on Structuring a Win-Win Deal

In the world of business acquisitions, rarely does a deal come together with a one-size-fits-all approach. Buyers and sellers often have different priorities, and traditional financing sometimes falls short of meeting everyone’s needs.

Evan Howard

May 2, 20257 min read

The Removal of Loan Contingency in NC Real Estate Form 580-T: A Consumer's Nightmare

he North Carolina Association of REALTORS® (NCAR) has made a significant change to Standard Form 580-T, the Offer to Purchase and Contract form, by removing the agent commission contingent on financing.

Evan Howard

Apr 30, 20255 min read

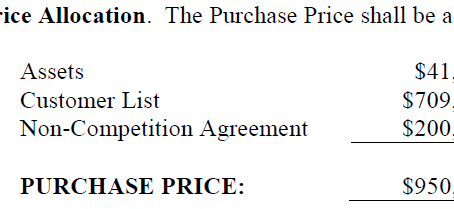

Understanding Purchase Price Allocation in a Purchase Agreement

Purchase price allocation is a foundational process in any business acquisition, with far-reaching implications for financial reporting, tax planning, and negotiation strategy.

Evan Howard

Apr 18, 20255 min read

Business Broker Commission if Transaction Fails; Carolina Business Brokers V. Strickland

Sunbelt sues for commission of failed transaction and loses; eventually.

Evan Howard

Apr 14, 20255 min read

Unveiling the Unknown: A Brief Overview of the M&A Process

Understanding the M&A process is not just about acquiring a business; it is about strategic growth and vision.

Evan Howard

Mar 23, 20254 min read

Understanding the Differences Between a Stock Sale and an Asset Sale

Here we will delve into the specifics of these differences to help understand the implications a stock and asset sale.

Evan Howard

Mar 23, 20254 min read

How SBA 7(a) Loans Can Benefit Your Small Business: Exploring Eligibility, Maximum Loan Amount, and More

In an ever-changing entrepreneurial landscape, small businesses play a crucial role in our economy.

Evan Howard

Mar 12, 20254 min read

bottom of page