top of page

Call or Text: 980-272-7322

Search

What Is a Micro Acquisition? An Introduction for Main Street Business Owners

You may have heard the term micro acquisition thrown around in business circles, especially as more Main Street business owners look for practical, profitable ways to exit or expand.

Evan Howard

Apr 28, 20257 min read

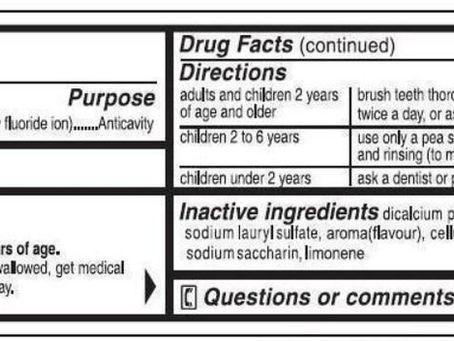

Toothpaste Regulation: How Ingredients and Marketing Claims Can Trigger Clinical Trial Requirement

Toothpaste is a product almost every American uses daily, but few consumers realize the regulatory complexity behind that familiar tube.

Evan Howard

Apr 28, 20256 min read

Understanding Debt Service Coverage Ratio (DSCR) in Business Acquisitions

The DSCR is a measure of the cash flow a business generates relative to its debt payments. In simple terms, it answers the question: "Does this business generate enough income to comfortably pay its debts?"

Evan Howard

Apr 27, 20257 min read

Legal Consequences When Majority Shareholders or Directors Steal From a Company: Case Examples and Analysis

When a majority shareholder or board member steals from a company, they breach their fiduciary duties and expose themselves to serious legal and financial repercussions, as well as lasting reputational damage.

Evan Howard

Apr 26, 20257 min read

The Dreaded Addbacks in Business Valuation

ddbacks are adjustments made to a business’s earnings—typically EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)—to account for discretionary, non-recurring, or non-operational expenses.

Evan Howard

Apr 25, 20255 min read

Shareholder Rights in Mergers and Acquisitions: Navigating Minority Protections, Forced Sales, and Legal Recourse

In the high-stakes world of mergers and acquisitions (M&A), the rights of shareholders—especially those in the minority—are a critical part of the corporate governance landscape.

Evan Howard

Apr 25, 20259 min read

Understanding the SBA’s New Equity Injection Rules: What Borrowers Need to Know About SOP 50 10

Under the updated SOP 50 10, any transaction resulting in a complete change of ownership—such as purchasing a business or acquiring a partner’s stake—requires the borrower to contribute a minimum of 10% of the total project costs as an equity injection. Are there exceptions?

Evan Howard

Apr 24, 20254 min read

Understanding Majority Shareholder Oppression: Common Tactics Used Against Minority Shareholders

When you invest in a company as a minority shareholder, you expect fair treatment, transparency, and a voice in major decisions. Unfortunately, the reality can sometimes be very different.

Evan Howard

Apr 24, 20254 min read

What is a Type D Tax-Free Reorganization?

A Type D tax-free reorganization is a corporate restructuring mechanism under the U.S. Internal Revenue Code (IRC) that allows businesses to transfer assets between corporations without triggering immediate tax consequences.

Evan Howard

Apr 23, 20255 min read

SBA SOP 50 10 7.1: The Rulebook Behind America’s Small Business Loans

At its core, SOP 50 10 is the SBA’s instruction manual for lenders. It spells out everything from eligibility rules to how loans get approved, disbursed, and monitored.

Evan Howard

Apr 22, 20254 min read

Investor Veto Rights Vetoed by the Court: How Delaware’s Moelis & Co. Decision Changed the Game

Delaware Court of Chancery ruling sent shock waves through the venture capital and private equity worlds.

Evan Howard

Apr 22, 20255 min read

The Great Corporate Migration: Why Companies Are Fleeing Delaware’s Courts

DEXIT showing to be a possible exodus of US corporations from the once business friendly State of Delaware.

Evan Howard

Apr 21, 20255 min read

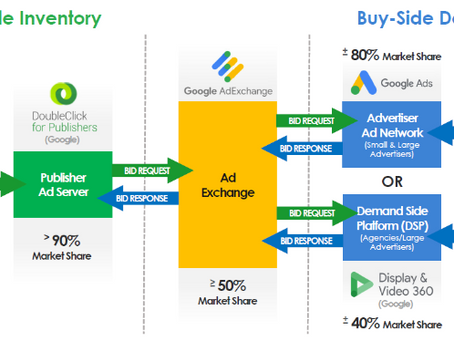

Google’s Antitrust Showdown: What the DOJ’s Case Means for the Future of Big Tech

If you’ve been following the headlines, you know the U.S. Department of Justice (DOJ) has been locked in a high-stakes legal battle with Google. This isn’t just another lawsuit—it’s a defining moment in how antitrust laws apply to the digital age.

Evan Howard

Apr 20, 20256 min read

Google and Standard Oil: Antitrust Echoes Across a Century

The world of antitrust law has come full circle. Over a century after the landmark breakup of Standard Oil, the United States government is again in court with a corporate giant—this time, Google.

Evan Howard

Apr 19, 20257 min read

The Sherman Act & Clayton Act: America’s Antitrust Power Duo Explained

Imagine a world where a single company controls the price of every gallon of gas, every loaf of bread, and every phone in your pocket. That’s the nightmare U.S. antitrust laws like the Sherman Act (1890) and Clayton Act (1914) were designed to prevent.

Evan Howard

Apr 18, 20253 min read

Business Broker Commission if Transaction Fails; Carolina Business Brokers V. Strickland

Sunbelt sues for commission of failed transaction and loses; eventually.

Evan Howard

Apr 14, 20255 min read

Type C Tax-Free Reorganization: Comprehensive Overview

Allowing one corporation to acquire substantially all the assets of another corporation in exchange for voting stock - tax-free treatment

Evan Howard

Apr 6, 20254 min read

Understanding Type B Tax-Free Reorganizations: Structure, Rules, and Benefits

Type B Tax-Free Reorganization - a stock for stock swap with no tax implications

Evan Howard

Apr 5, 20255 min read

What is a Type A Statutory Tax-Free Merger or Consolidation?

The Type A statutory merger or consolidation is a structured process that empowers companies to strategically attain objectives

Evan Howard

Apr 4, 20258 min read

Types of Corporate Reorganizations and When They are Useful

Learn about the 7 types of corporate reorganizations under IRC Section 368 and when they are useful for tax-deferred treatment.

Evan Howard

Apr 3, 20253 min read

bottom of page